Policy Uncertainty *before* 30% Tariffs on EU, Mexico … and Rosie O’Donnell

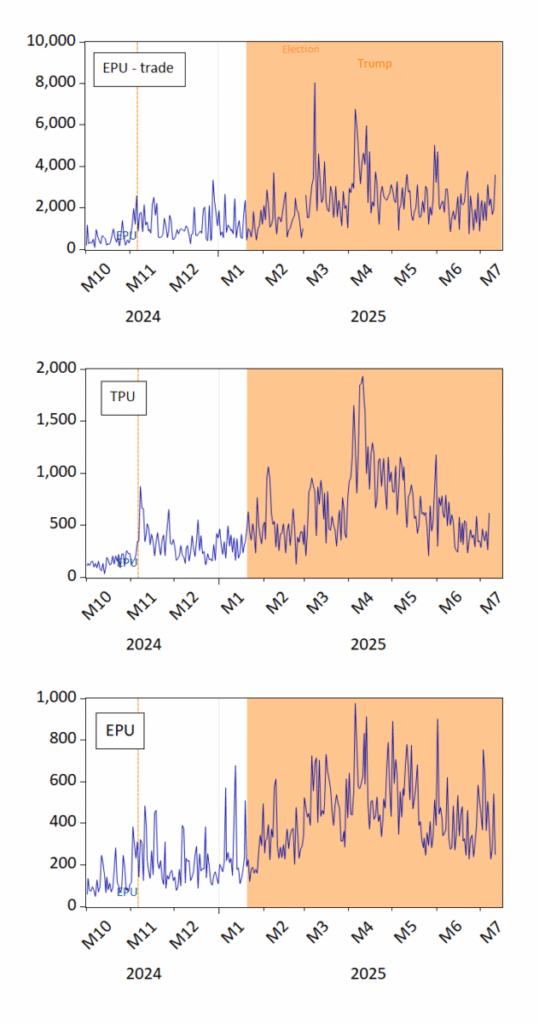

See here and here. Every morning I wake up, think I can’t see anything more crazy than what occurred yesterday, and then I check the news. Figure 1: Top panel, EPU-trade; Middle panel: Trade Policy Uncertainty; Bottom panel: EPU. Orange shading denotes second Trump administration. Orange dashed line denotes election. Source: policyuncertainty.com, Iacoviello et al. […]

Policy Uncertainty *before* 30% Tariffs on EU, Mexico … and Rosie O’Donnell Read More »